The card business is not simply another product within a financial institution — it is a strategic driver of revenue and customer engagement.

In Argentina, card payments account for approximately 45% of digital transactions, playing a central role in everyday consumption and customer loyalty. Globally, studies indicate that many issuers generate between 20% and 30% of their net revenue from card products, supported by interchange fees, financing income, and recurring usage benefits.

In this context, efficiently managing the card business becomes a critical capability for any bank.

What Is a Card Core Platform?

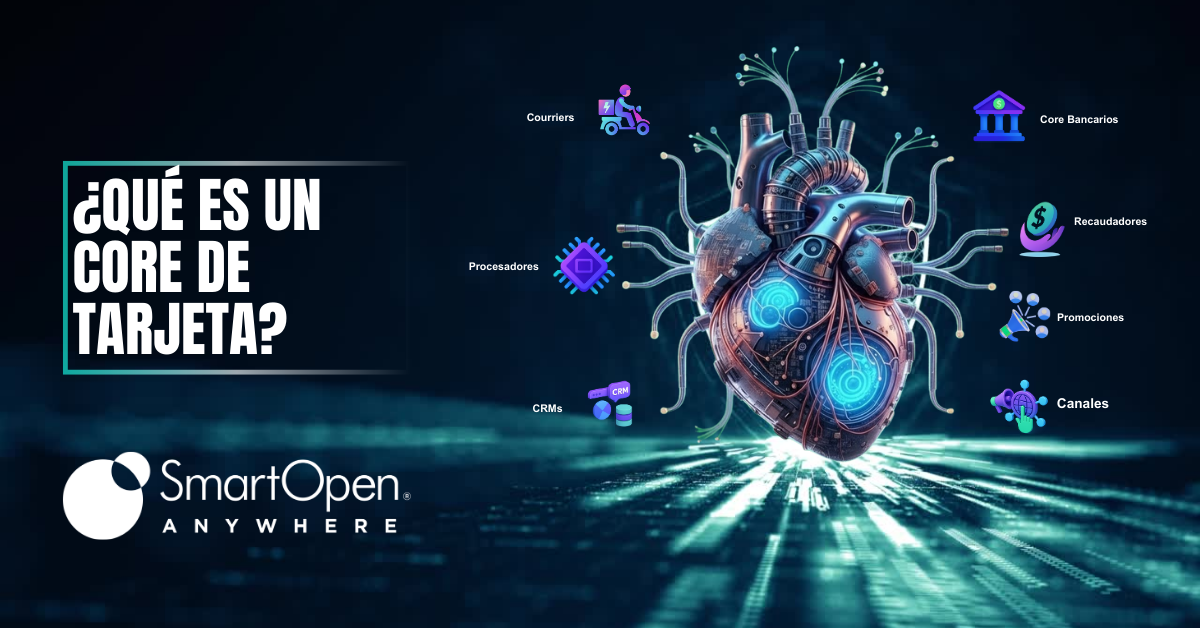

A card core platform is the central system that manages the entire card business, from the issuer’s and paying bank’s perspective.

It governs products, rules, and processes, acting as a technological backbone that orchestrates the bank’s internal ecosystem with external actors such as processors, couriers, and collection entities. Importantly, it enables banks to define their own business rules beyond those imposed by processors or market standards, providing strategic autonomy and operational control.

A robust card core does not merely manage transactions — it enables commercial strategies, loyalty models, and long-term growth.

Team Quality Corp’s Experience in the Card Business

For more than 25 years, Team Quality Corp has been developing solutions for the card business, working closely with financial institutions to understand their operations, complexity, and interactions within the broader payments ecosystem.

This experience led to the development of a platform designed to fully govern the card business: SmartOpen Anywhere.

Today, the solution is available in both on-premise and SaaS deployment models, maintaining operational flexibility while ensuring full business control.

What Can Be Managed with SmartOpen Anywhere?

Through SmartOpen Anywhere, banks can:

- Integrate and consolidate ecosystem participants, including processors and card brands

- Define and manage promotions, benefits, and loyalty programs

- Oversee card logistics and distribution

- Orchestrate interactions with the banking core, recovery systems, and accounting platforms

- Automate business events and processes, including real-time transaction flows with processors

This comprehensive capability enables financial institutions to strengthen their market positioning, optimize operations, and capture greater value from their card business.